We are licensed with one priority—you and your family. Therefore, our team is strongly committed to helping you find the best annuity, life and health insurance coverage policies customized to fit your needs, goals, and budget so that you and your family can experience and enjoy the best things in life worry-free!

We all want our children to be educated, successful and live a wealthy and healthy life in the future. There are multiple ways parents save money for their kid’s college education, such as Saving Account, Roth IRAs Brokerage Account, Custodial Accounts, Coverdell Education Saving Account, State 529 Education Saving Plan and Indexed Account Saving Plan.

Today, In-Resident college student cost in Seattle, Washington State is around $30,640 per year.

With 1.1% inflation rates in year 2034 the cost will be $35,026 and it keeps going up and up every year. This means that you should start saving now before it’s too late.

The State 529 College Saving Plan is a section of the internal revenue code. It authorizes educational saving plans. The State 529 plan is state sponsored and tax advantaged college saving plan designed to be used for qualifying educational expenses, including school tuition, room and board, meal plans, books & supplies, technology, special equipment (wheel chair, etc) are qualified expenses.

You can go to the Federal School Code Lookup tool website to see which school is eligible for a 529 plan.

https://www.savingforcollege.com/eligible-institutions

It’s like a Roth IRA but designed for education savings instead of retirement. The plan is sponsored by educational institutions, state agencies, and states. The plan offers tax benefits as you save money for your child’s college education. In many states, you receive State tax deduction or tax credit. You can reinvest the return for the next year payment. It is divided into two types:

Under the prepaid plan, you buy credits at a participating university or college for your child’s future tuition at the current price. Please note, it, however, doesn’t cover room or board. Plus, you can’t use it to pay tuition for elementary and secondary schools.

The majority of the prepaid tuition plans are state-government-sponsored. Therefore, they have a residency requirement for the beneficiary. Some states guarantee the money paid into the prepaid tuition plan, while others don’t. This means that if your prepaid tuition is not guaranteed, you will end up losing all or some of the tuition payments. Moreover, if the beneficiary doesn’t attend the participating college, the plan will pay less towards the beneficiary’s college tuition.

This is another type of State 529 plan. It works as an investment plan while giving you more variety to choose from. With the Education Savings Plan, you can save for your child’s tuition, board, room, and other associated fees. Unlike the Prepaid Plan, the Education Savings Plan is not limited to a participating college. You can use it at any school and sometimes even outside the U.S. Moreover, you can use up to $10,000 to pay for private, public, regional, and secondary school tuition. You can easily save using investment options such as exchange-traded funds and mutual funds, to name a few.

Here potential policyholders must understand that 529 plans are not FDIC insured. These plans are not deposits of financial institutions. Hence, they are subject to investment risk. This means that, as with most investment plans, you are at risk of losing some or all of your money with the Education Saving Plan too. Its like a variable account.

Also, even though you can use the money from education Saving Plan at any school, if the money for qualified higher education expenses or tuition for elementary or secondary school is not used, then you will have to pay the state and federal income taxes and a 10 percent federal tax penalty on earnings.

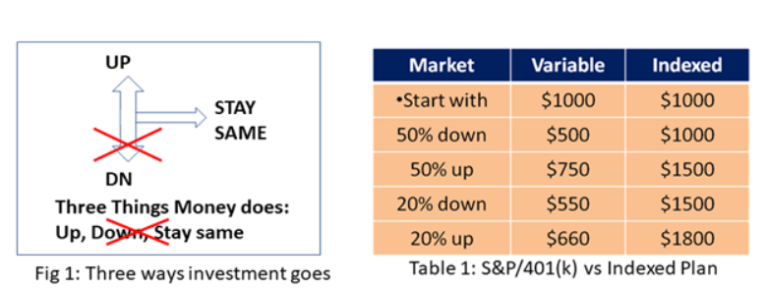

The Table 1 shows how the saving goes up and down based on the market. You start an account with $1000. When market is 50% down, you left with $500 in saving. Next market goes up 50%. This time you will have $750 in saving because 50% of $500 is $250. ($500+ $250 = $750).

Therefore it is highly recommended that you must carefully review and evaluate the pros and cons of the 529 plan. This includes disclosure statement, program description, offering document, disclosure document, and the fee charged for the plan. A careful evaluation will help you in making an informed plan selection.

This is an education saving plan and Tax-Free Retirement plan is designed by the insurance companies such as Annuity is a contract between client and insurance company. College Saving Plan and Tax-Free retirement are backed by the permanent Indexed Universal Life (IUL) insurance. Some investors referred to this as an advanced life insurance product. The premiums are determined on the basis of policy type, face amount, age, risk evaluation based on health status and optional riders. Premium covers the cost of insurance and expenses and the remaining premium goes to a cash-value account where it grows via fixed and indexed account, such as the S&P 500 or the Nasdaq-100. Cash-value accumulation occurs within two sub-accounts: Fixed account and Indexed account.

Its a long-term Risk-Free investment plan. Mean if you invest an early age it gives you high return without any lose. Your money is always safe.

The investment in this policy is like a staircase as shown on chart 2. Fig 1 shows money goes up, stays the same but never goes down. Your money is protected from going down. It is a guarantee that you will never lose money.

Even though an IUL is a life insurance living benefit policy, which gives you safe tax-free retirement and saving for college expenses. The investment in this policy accumulates wealth through a tax-deferred interest crediting basis. The excess premium paid by the policyholder is placed in the sub-account that continues to earn interest on an index like S&P 500 or NASDAQ. IUL is an attractive option because it is not as volatile as other policies available in the market. This is because your money is not invested in the equities in real, but the insurance company mimics the index returns.

Indexed Universal Life insurance policy emphasizes the cap and floor rate. As you see in Chart 1 and Fig 1. Therefore the returns are guaranteed because of the floor rate the IUL policy offers. This further means that even if the index is in loss, your account will be credited. The policyholder will not lose any money or be negatively impacted in any given situation.

There is no plenty on early withdrawal at any age. Mean you can withdraw money to buy business or, car or a house down payment.

You can use the money for any college expenses at any university in the US or abroad.

Most important to know, this plan is not considered as an asset. Financial Planners can’t use this savings in calculating financial aid, student loan and scholarship. It means your child will be qualifying for financial aid and student loans or scholarship.

Investing at the early age gives your child higher college savings and higher retirement. When a child turns sixteen and starts working part time, have the child pay part of the college savings plan payments. After the graduation your child continues making the monthly payment for higher retirement. The best thing about this policy is that there is no restriction on payment. You can pay more or less. For example, during Christmas time we buy so many gifts for our loved ones and we are short in money. So you can pay less for December month and pay more after receiving the tax return. Its all up to you.

I have noticed these days’ financial advisors, insurance agents, and parents are buying this policy for their kids, for themselves so they will have tax free retirement in old age.

IUL offers a great retirement plan as long as you continue to make payments on the policy, the cash value will grow tax-deferred. If you start early, by the age of 65 you will have good tax-free retirement for life. Upon your death, your family will get the tax-free death benefit.

However, if you withdraw money from the policy before age 59 ½ you may have to pay tax on gain. Please note that if the loan is not paid back, your death benefit will be used to balance the loan due. This is where you have to be careful about it

Another reason why IUL/Tax-Free retirement plan is the best option and most preferred is that IRS has established no limit with premiums paid with indexed universal life insurance into LIRP (life insurance retirement plans). However, options like Life Insurance Retirement Plans such as 401k or IRA have limitations.

For example, in a 401(k) plan, the annual contributions are limited to approximately $20,500 annually. This can seriously impact your wealth accumulation when you reach the mandatory distribution age of 70 ½.

IUL is an insurance with death benefit plus it has living retirement benefit. This makes the policy benefit in both ways. If you, the policyholder, die early, your beneficiary will be given a tax-free death benefit, thereby it becomes easier for them to pay for your funeral expenses without the financial burden. On the other hand, if you live long, you can enjoy the savings after retiring and continue to maintain your lifestyle.

Physicians, Dentists, and DVM’s can take money out from saving for their business without penalty at any age. If you have a 401(k) policy and wish to withdraw money before 59 ½ years of age, you will have to pay income tax on the withdrawal amount. In the majority of cases, this is around 10 percent. However, with IUL, you can withdraw money at any time without any tax liability or penalties.

This policy is a very powerful financial tool for protecting the financial well-being of your family for decades to come—even after death. With this policy in hand, you will have the flexibility to build assets and deal with life's uncertainties. Ever since 2020, many medical professionals, including physicians and nurses, have lost their lives in the quest of saving others from COVID-19. They are our real heroes.

Nonetheless, those medical professionals at the forefront, putting their lives at risk in saving the lives of patients from COVID-19; they need their own and family protection if something happens to them. You can borrow against the savings in policy for your children’s education, down house payment, or buy a car. Medical coverage can be used for any uncertainties that may come in future.

Withdrawals will reduce your cash-value dollar to dollar. Full Surrender may have some tax implications. With IUL, you get the flexibility of taking out a loan without facing penalties, credit checks, or taxes. It will not reduce your cash-value account. Moreover, you don't have to return the money you take out. This makes the policy far more attractive than other options available.

Not many people know, this policy is not considered an asset when it comes to financial aid or scholarships. But the State 529 College saving plan is considered as an asset. The college financial advisor will calculate it as an asset to determine the financial aid amount they will be awarded, but the IUL policy will not be included.

Our life is unpredictable. No one knows what will happen at any age. Spending too many hours at work is a leading cause of burnout, heart attack and stroke. What if you had a heart attack and treated at the hospital. Health insurance pays 50 to 80%, rest 20 to 50% comes from your savings. What if insurance pays the 20 to 50% would you call it an investment? Yes, I will. This insurance policy covers heart attack, stocks, cancer, heart disease, lung disease, liver disease, and more at no extra cost. Moreover, this policy gives you tax-free retirement for life with other benefits.

Life and health fragile and no one know what will happen tomorrow. You don’t have to buy Terminal Illness, Critical Illness, and Chronic Illness coverage because it comes with a policy.

After using money for college education, continue paying premium, Your Child would have:

(1) Tax-Free Retirement Plan for your Child

(2) No need to buy family protection for his family.

(3) If in some case bad happened with health, you child will be covered under critical illness, chronic illness and terminal illness

(4) Take money out for house down payment or buy new car or buy business

(5) Premium will never go up like other life insurance companies.

It's always wise to have a life insurance policy for your children and grandchildren. This is not the reason that they die before you and you collect the money. It creates (1) College saving (2) Tax-free retirement. (3) Family protection and (4) Medical Benefits, such as chronic illness, Critical Illness, and Terminal Illness.

| State 529 Plan | Indexed Plan | |

| Payment | There are two plans: Prepaid and Education saving plan | Pay monthly premium for life insurance. Cash value grows. Take a loan for college education while money in cash-value grows. |

| Guarantee | No. It’s a State-government-sponsored plan. Some states guarantee the money paid into the prepaid tuition plan, while others don't. This means that if your prepaid tuition is not guaranteed, you will end up losing all or some of the tuition payments | Yes, You have control. IUL has a floor rate equal to 0-2%. Never lose money.

This is this plan called “Zero is Hero” |

| Tuition | If the beneficiary doesn't attend the participating college, the plan will pay less towards the beneficiary's college tuition. | Beneficiaries can attend any college in the US or aboard. |

| Secured investment | No. 529 plans are not FDIC insured. So it is subject to investment risk. | IUL is secured because it has a Floor Rate equal to 0-2%. Even if the market crashes, your money is safe. Zero is Hero |

| Tax and Fine | If the money for qualified higher education expenses or tuition for elementary or secondary school is not used, then you will have to pay the state and federal income taxes and a 10 percent federal tax penalty on earnings | No fine and tax.

If the beneficiary does not go to college, money can be used to buy business or home or car |

| Financial Aid | Doesn’t qualify for Financial Aid. | Qualify for Financial Aid. Not many people know this, but IUL is not considered an asset when calculating the amount for financial aid. So, when your child applies for financial aid, your financial advisor will calculate the assets to determine the financial aid amount they will be awarded, but the IUL policy will not be included. |

| Retirement | NA | Cash value build up for retirement at age 65.

Call us for illustration |

| Terminal Illness, Critical Illness, & Chronic Illness | NA | It comes with terminal Illness, Critical Illness, and Chronic Illness coverage. |

© 2022 American Financial Consulting. All rights reserved.